Maximum Charitable Deduction 2025. The percentages are based off what you donate and who you donate it to, with a. The irs has announced increases in tax exemptions, qualified charitable distribution (qcd) gift limits, and standard deductions for 2025.

To help you navigate the latest irs tax updates from 2025 to 2025, we’ve put together a guide including the updated tax brackets, charitable deduction limits, how. 1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd.

How to Maximize Your Charity Tax Deductible Donation WealthFit, Section 80ttb is applicable for senior citizens. The percentages are based off what you donate and who you donate it to, with a.

Revisiting “The Charitable Deduction in American Political Thought, The percentages are based off what you donate and who you donate it to, with a. How do estate and gift taxes actually work?

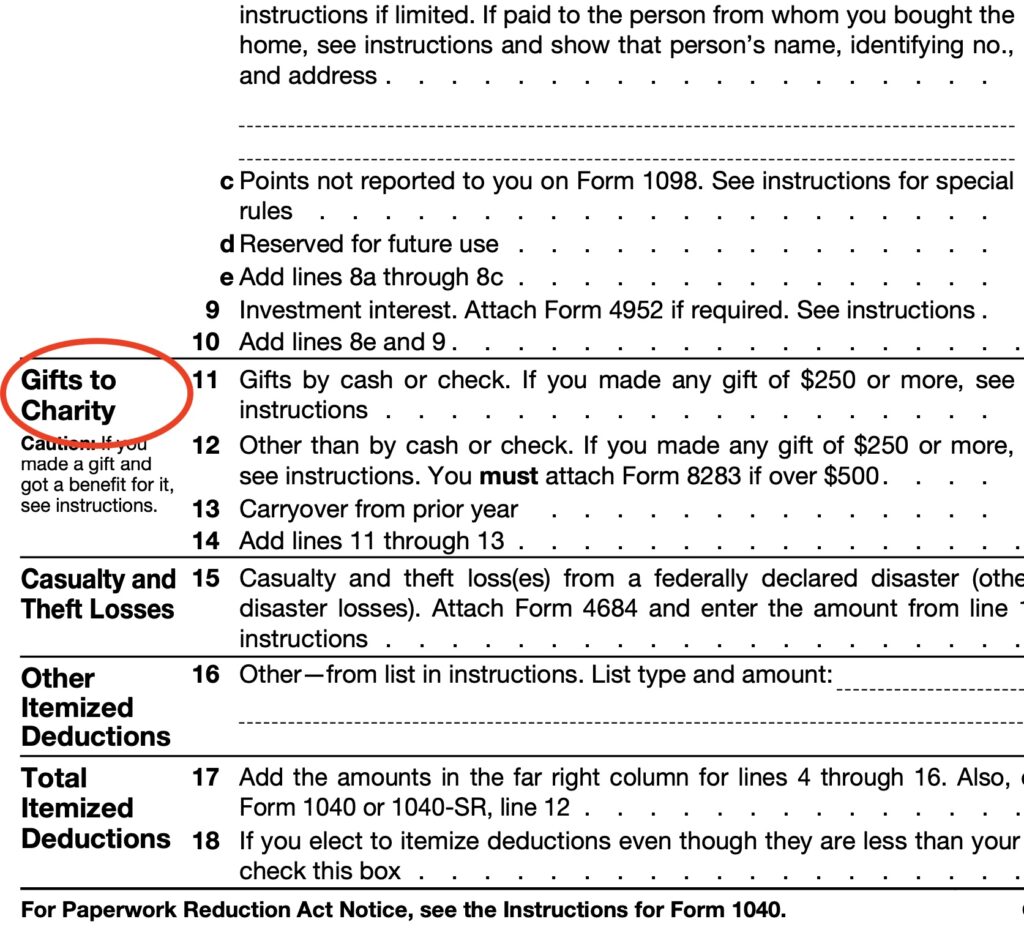

Charity Deductions Taxed Right, For instance, if your agi is $100,000 in 2025, the maximum amount you could claim as a charitable contribution deduction would be $60,000, according to the 60% agi limitation. The maximum allowable tax deduction under this section is rs 1.5 lakh.

2025 Charitable Contribution Limits Darcy Melodie, How do estate and gift taxes actually work? One of the most significant tax advantages of charitable giving is the ability to claim a tax deduction for your donations.

How large are individual tax incentives for charitable giving, Charitable giving in the united states is alive. The central board of direct taxes (cbdt), under the ministry of finance, has issued a comprehensive clarification regarding provisions under the finance act 2025 concerning donations made by trusts or institutions to other trusts or institutions.

What Is The Max Contribution For 401k In 2025 Kala Teressa, At help you navigate the latest income tax updates from 2025 to 2025, we’ve put joint a guide including the updated tax brackets, charitable conclusion limits,. For instance, if your agi is $100,000 in 2025, the maximum amount you could claim as a charitable contribution deduction would be $60,000, according to the 60% agi limitation.

Hsa Max Limits 2025 Charyl Merrielle, For instance, if your agi is $100,000 in 2025, the maximum amount you could claim as a charitable contribution deduction would be $60,000, according to the 60% agi limitation. The percentages are based off what you donate and who you donate it to, with a.

Sep Ira Contribution Limits 2025 Deadline Dasha Emmalee, Maximizing estate benefits before 2025. The maximum allowable tax deduction under this section is rs 1.5 lakh.

2025 Standard Deduction Mfs Wendi Sarita, There are maximum irs charitable donation amounts, but they are a percentage and not a defined dollar amount. When you make a donation to a qualified charitable.

Family Hsa Limits 2025 Hedda Chandal, 1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd. By offering income tax relief, the government hopes to encourage.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,.